What is VeriFactu?

The VeriFactu is a system implemented by the Spanish Tax Agency (AEAT) with the aim of reinforcing tax transparency and combating fraud through the digitalization of billing processes. VeriFactu in Spain comes into effect on:

- January 1, 2026: It is mandatory for companies subject to the Corporate Tax (i.e., commercial companies).

- July 1, 2026: Extension of the obligation to self-employed individuals and other taxpayers (Personal Income Tax, direct estimation)

This system requires that each issued invoice includes a QR code validated by the AEAT, allowing customers to verify the authenticity of the invoice in real time. Additionally, VeriFactu ensures the integrity of the data and the traceability of transactions, reinforcing the fight against tax fraud.

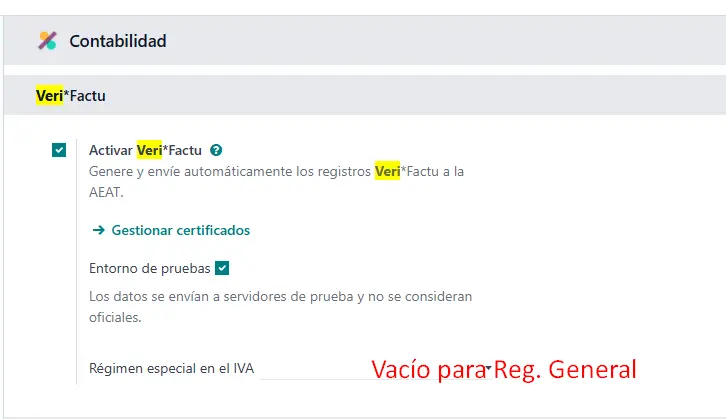

IMPORTANT NOTE: IN ODOO ENTERPRISE, THE Special regime field in VAT must be empty for the Normal VAT of the GENERAL regime; it is incorrectly selected in the video.

Access the presentation by clicking Here

Access the presentation by clicking Here

VERIFACTU MODALITIES

a) VeriFactu software with automatic sending — sends the invoice to the AEAT at the time of issuance (real-time telemetry).

b) Compliant software without automatic sending — does not send the invoice at the moment of issuance, but meets all technical requirements (record chaining, encryption and custody, event log and proof of cancellation/correction, and the ability to evidence and provide records to the AEAT upon request).

It is important to review the following nuances:

The owner of the server or whoever has access to it usually takes responsibility. If the server belongs to the Partner, it is advisable for the Partner to be responsible. If it belongs to the client, the client themselves would be the one with access and therefore, the responsible party.

Link now to AEAT Declaration Responsible Verifactu

Responsible Declaration Certificate Odoo AEAT

Responsible Declaration for Verifactu in your Odoo?

Join Contaldia: The first Odoo Consultancy since 2009

+50

Professionals

At Your Service: Tax, Accounting, and Labor Experts

2

In Barcelona and Madrid

Online and In-Person for any meeting

+30

Years advising

Advising thousands of companies since 1985

+500

Customers

They have trusted in our services

Companies and self-employed individuals

All companies and self-employed professionals operating in Spain, regardless of their size or sector of activity.

Subject to VAT

Any entity subject to Value Added Tax (VAT) in Spain must adopt this invoicing system.

Billing software users

Those who use billing programs or POS systems are required to update their systems to generate invoices with the QR code validated by the AEAT.

Companies in modules and simplified billing

Even those who operate under the module system must adapt their systems to comply with the requirements of VeriFactu AEAT

Who is exempt from using VeriFactu?

The VeriFactu system affects most entrepreneurs and professionals who issue invoices using billing software. However, the following subjects are exempt from its application.

Business owners or professionals who issue all their invoices manually, that is, without using billing software systems

Companies and professionals subject to the Immediate Supply of Information (SII), as this system already meets the control requirements set by the Tax Agency.

Taxpayers with a tax residence in the Historical Territories of the Basque Country or in the Foral Community of Navarre, due to the fact that these regions have their own tax control systems, such as TicketBAI.

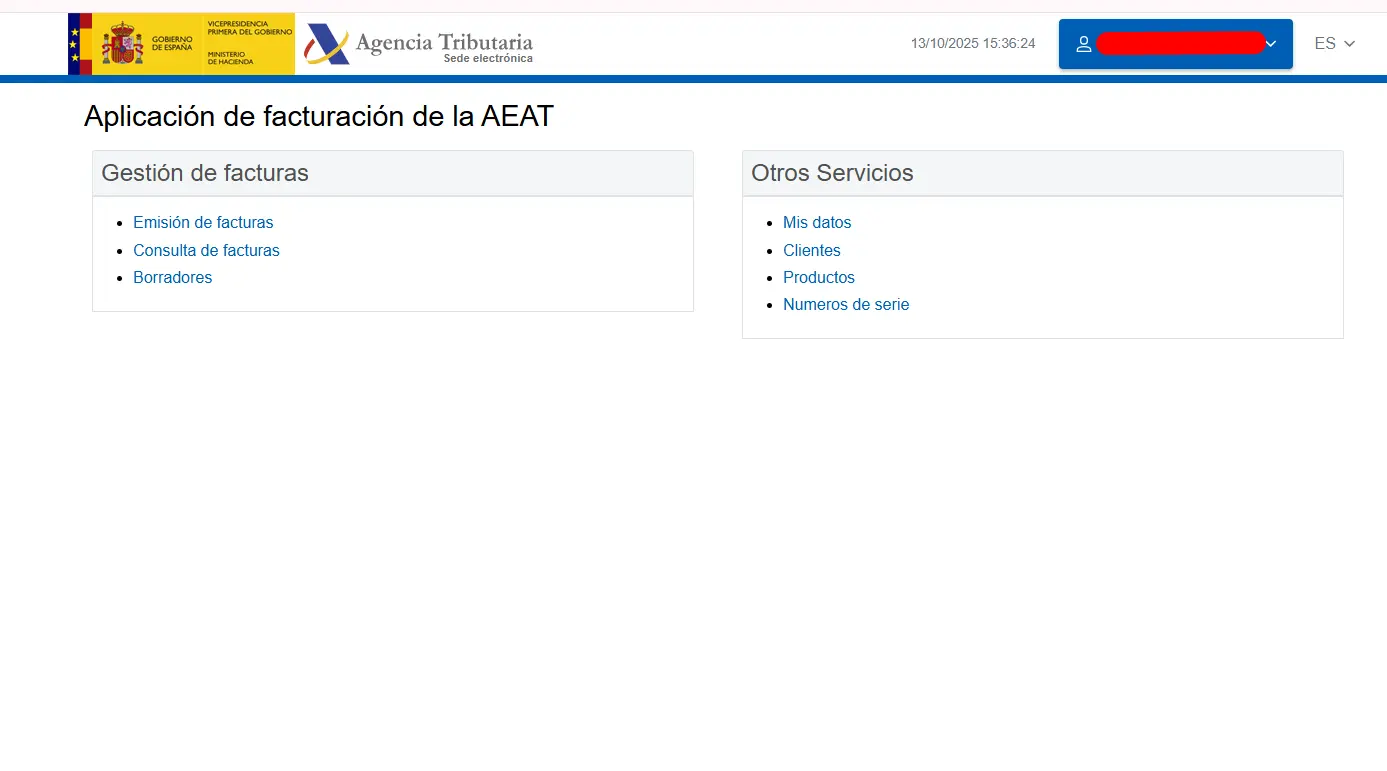

AEAT manual NO!

They now have the manual method for uploading invoices from Verifactu available.

It is not advisable at all, and there is a limit on invoices, but we provide it to help you create and send your invoice to Verifactu

VeriFactu in Odoo: Compliance and Adaptation

Odoo is already prepared and you can test it starting from July 2025. It is one of the most popular and flexible ERP systems for business management and accounting, and it has developed specific solutions to meet the requirements of VeriFactu AEAT. These solutions are available for both the Enterprise and Community versions, ensuring regulatory compliance regardless of the version used.

500+ Companies have trusted us.

Join Contaldia to Optimize your company's accounting and taxation.

Contact usOdoo Enterprise and OCA Approved by the AEAT

The Enterprise version of Odoo has been certified by the AEAT, which guarantees that it meets all the requirements of VeriFactu. This certification ensures:

The generation of verifiable electronic invoices with the QR code validated by the AEAT.

Direct integration with the AEAT for sending and validating invoices.

The complete traceability of transactions, ensuring regulatory compliance.

More information at: https://www.odoo.com/es_ES/blog/business-hacks-1/sistema-verifactu-en-espana-1464?

VeriFactu Modules for Odoo Community

For users of the Community version of Odoo, the OCA (Odoo Community Association) has developed specific modules to ensure compliance with VeriFactu AEAT. These modules allow the Community version to be adapted without the need to migrate to Enterprise.

AEAT VeriFactu Base:

- It establishes the foundation for integration with the Verifactu System.

- It enables the generation and submission of electronic invoices with a QR code in compliance with AEAT standards.

- It ensures the integrity and authenticity of the data in each invoice.

AEAT VeriFactu POS (TPV)

- Designed for Odoo's Point of Sale (POS) module.

- Ensures that transactions made through the POS are recorded and submitted in accordance with VeriFactu requirements.

- Includes the automatic generation of the QR code on sales receipts.

VeriFactu Tracking

- Facilitates the monitoring and tracking of submitted invoices.

- Ensures the traceability of all transactions in compliance with regulations.

- Generates reports and alerts in case of errors or discrepancies in the invoices.

COMMUNITY MODULES

v14: https://github.com/OCA/l10n-spain/pull/3973

v16: https://github.com/OCA/l10n-spain/pull/3579

v17: https://github.com/OCA/l10n-spain/pull/4399

v18: https://github.com/OCA/l10n-spain/pull/4046

FAQ

We help resolve the most common questions about Verifactu and Odoo

Only information related to issued invoices (sales) is sent; purchases and expenses are not included.

The submission to the Tax Authority must be made at the time of the invoice issuance, that is, immediately or almost simultaneously, in compliance with the principle of integrity and traceability established by the regulations.

- Verifactu: It only requires the submission of information related to sales.

- SII (Immediate Supply of Information): Requires the submission of both sales and purchases. Applicable to companies with a turnover exceeding 6 million euros, among other cases.

Therefore, the SII is more demanding for the taxpayer, as the tax authority receives more information. If a company is not required to adhere to the SII, it is preferable to remain solely with Verifactu.

No, companies that are in the SII do not need to implement Verifactu. Compliance with the SII is sufficient.

- If the company is required to use the SII, it cannot choose Verifactu.

- If not required, you can choose between using VeriFactu or voluntarily joining the SII, although the latter option is not recommended.

It’s available in both Odoo Enterprise and Odoo Community in the latest versions 17, 18, and 19. Odoo Community (via the OCA) will likely have earlier versions of VeriFactu available—feel free to check them out at https://github.com/OCA/l10n-spain

The responsibility for the accuracy and submission of data is a key aspect of the Verifactu system, and the Treasury pays special attention to this point.

- Cloud hosting by your partner: The responsibility for ensuring compliance with Verifactu lies with your partner.

- On-Premise Hosting or Odoo.sh: In these cases, the responsibility falls directly on the client, who must ensure the proper transmission and custody of the information.

- Obtain the responsible declaration from AEAT at https://sede.agenciatributaria.gob.es/Sede/iva/sistemas-informaticos-facturacion-verifactu/preguntas-frecuentes/certificacion-sistemas-informaticos-declaracion-responsable.html

- 23 de abril de 2025: Hacienda ya activó los primeros servicios del sistema en su Sede Electrónica para pruebas e integración sede.agenciatributaria.gob.es+14marosavat.com+14taclia.com+14.

- July 29, 2025: Software developers have until this date to adapt their programs following the publication of the technical order of RD 254/2025. Odoo already adapted.

- January 1, 2026: It is mandatory for companies subject to the Corporate Tax (i.e., commercial companies).

- July 1, 2026: Extension of the obligation to self-employed individuals and other taxpayers (Personal Income Tax, direct estimation)

Contact us

Our team of over 50 professionals is ready to help you digitize processes, comply with regulations, and improve your company's financial efficiency.

Phone